Mitchell Bank Customers

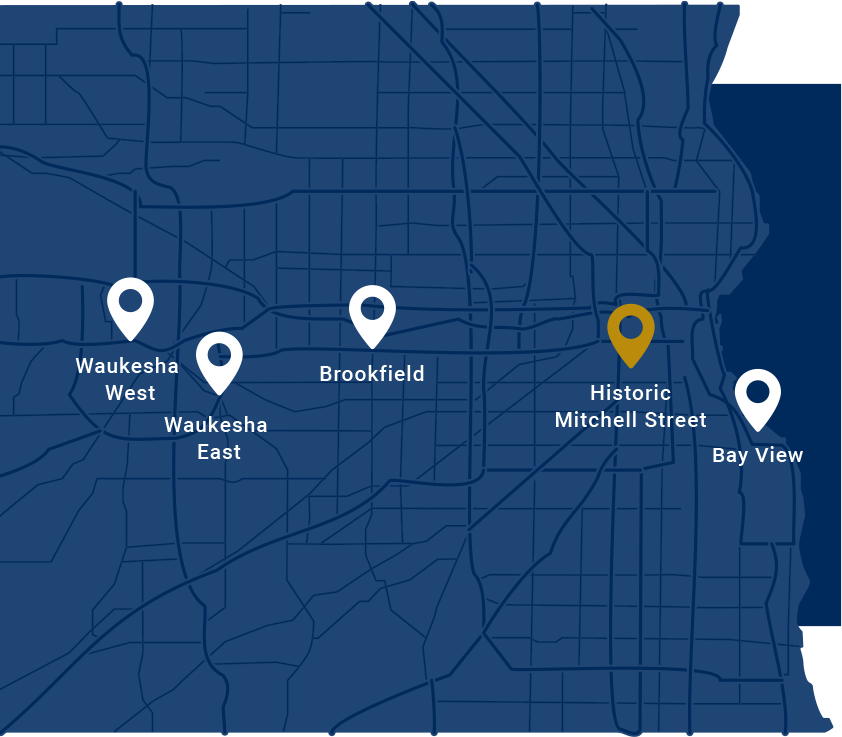

First Federal Bank has served local communities since 1922. As the result of the significant efforts of our team members and stakeholders, we have evolved into one of the strongest financial institutions in southeastern Wisconsin. This once sleepy hometown community bank has grown substantially in the last 10 years including a merger with Bay View Federal Savings and Loan Association, the construction of the Brookfield/New Berlin branch on the corner of Moorland and Greenfield, the recent reorganization into a public stock holding company, and the acquisition of Mitchell Bank.